Sell-side analysts still have an essential position in financial markets; with those crucial coverage numbers, they can help investors a lot..

Through their in-depth research and recommendations, they exert influence on stock valuations, market liquidity and overall market dynamics. Their buy, hold or sell ratings can cause stock prices to rise or fall, impacting investor decisions. Upgrades often lead to price surges, while downgrades may result in declines . . .

Sell-side analysts talk about coverage numbers, initiating research and the IR opportunities to be had around research and access.

Simona D’Agostino Reuter, HEAR-it, Founder

The buy side and sell side operate independently but remain closely intertwined.

While both are facing significant pressures, the buy side has been hit particularly hard by falling asset values, slower revenue growth, and tighter margins—trends made worse by the industry’s continued shift from active to passive investing.

The sell side, meanwhile, has had to adapt to equally demanding conditions, especially following the implementation of MiFID II, which has reshaped client relationships, research distribution, and pricing transparency. These regulatory changes have forced sell-side firms to rethink their business models and value propositions, while the buy side grapples with cost pressures and evolving expectations.

As we all know, MiFID II regulation, which aimed to increase transparency and protect investors, has significantly disrupted traditional revenue streams for sell-side firms. In particular, the requirement to unbundle research and execution costs has forced asset managers to scrutinize the value of broker research and pay for it separately, leading to a sharp decline in research budgets and demand for sell-side analysis. At the same time, greater transparency and tighter reporting standards have compressed trading margins and intensified competition.

As a result, many sell-side institutions have had to scale back research coverage, reduce staff, and streamline operations, contributing to a broader slowdown in activity across the sector.

When it comes to the $100 trillion-plus investment management industry, the buy side and the sell side are inextricably linked. Markets simply would not exist without both performing their crucial functions every day.

Is this really true?

The Sell Side’s Advantage: Details, Details, Details

But it is research where the sell side can add value now. Given all the above, buy-side firms need to budget their time and resources wisely between managing existing clients, developing new business, and conducting the level of investment research necessary to uncover those coveted outliers. That last one is getting trickier as buy-side firms continue to tighten their research budgets.

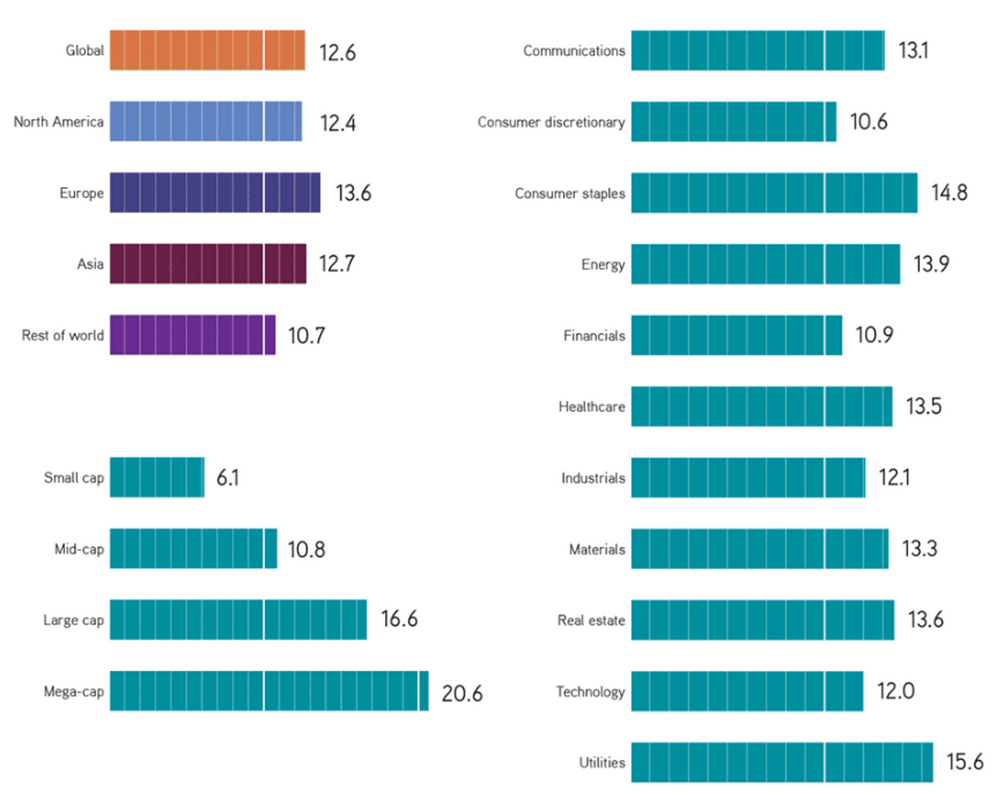

Sell-side research augments existing capabilities by providing deeper coverage of companies, industries, and evolving trends and topics. The sell side’s strength lies in the broad network of buy-side firms and companies it can tap into, and its ability to aggregate and summarize information gleaned to help managers make good investment decisions. Consider it one more set of many eyes. The research delves deep and also generates detailed forward-looking estimates, another important tool in the arsenal.

The process generally focuses on these key drivers: Company basics – including financial statement analysis, the development of valuation models, and comparable company research; Company key data – analysis of historical data to detect patterns and forecast future market movements; Industries and markets – evaluating trends within specific industries to help investors better understand core market dynamics.

Why Sell-Side Research Now? We believe Sell-side equity research is an omnipresent value add for investment managers that can be particularly effective in business environments like these, where gaining a competitive edge is getting harder by the minute.

Some CIOs downplay the importance of sell-side research, in many cases because they do not want their managers to be too heavily influenced by one source. But there is a reason why 90% of all sell-side equity research produced today is consumed by professional investment managers. Successful investing is about seeing what others miss, and the more sets of eyes the better. High-quality, granular information helps buy-side firms see beyond the headlines to find those potential outliers and make better-informed decisions.

In a series of anonymous conversations – with identities protected in order to get frank responses – IR Impact talked to sell-side analysts about their relationships with IR professionals.

Here we focus on the numbers, from how many analysts are covering a company – often used as a measure of successful IR (or maybe in the old days..) – to the kind of coverage IROs would like to have.

Source: IR-IMPACT.COM September 30, 2025

As a reminder, Key Characteristics of the Sell-Side

- Role as an Intermediary: Sell-side firms connect companies issuing securities (stocks, bonds) with potential buyers, the buy-side.

- Production and Distribution: They produce financial instruments and distribute them to the market.

- Provide Services: Sell-side entities offer research, advisory services, and execution services for transactions.

- Market Liquidity: Market makers on the sell-side provide liquidity to financial markets by standing ready to buy and sell securities.

- Business Model: They generate revenue through fees and commissions on the transactions they facilitate.